IPO Market Watch: 2023 and Beyond

The success of Capital markets has been essential in stewarding the velocity of investor returns short and long term by allowing shares to be traded through the stock exchange. Private organizations turned IPO pose a strategic advantage for the company by allowing access to financial opportunities, higher share valuation, investor exit opportunities, employee retention, and increase in liquidity as a public company, which is often evidenced through higher stock prices and market cap valuations.

Largely attributed to the COVID-19 pandemic, the IPO market has declined significantly, globally as well as in the United States. Capital raising activity has swiftly descended at the end of 3Q22 given the continuation of macroeconomic uncertainties and geopolitical tension in Ukraine, US-China, Taiwan, and North Korea concerns causing volatility in the markets.

Undoubtedly, 2022 has become severely silent in the IPO market and is expected to trend through a challenging path forward into fiscal year 2023 as the Federal Reserve continues to embark on its goal of achieving the infamous Federal Reserve funds rate of 2% through the period of 4 years. Inflation is above trend and may continue to potentially increase above 4.4% projected in September by year end.

High Valuations, extended Low Interest Rates, and robust investor demand for equities has long been a testament of an “Active” IPO Market. As of 3Q22, the IPO market has experienced a sharp decline across the board, however, it is expected to gain momentum as the Fed’s key indicators point in the direction of price stability and robust labor market while keeping a keen eye on the 2% target rate.

I. Global IPO Market Outlook

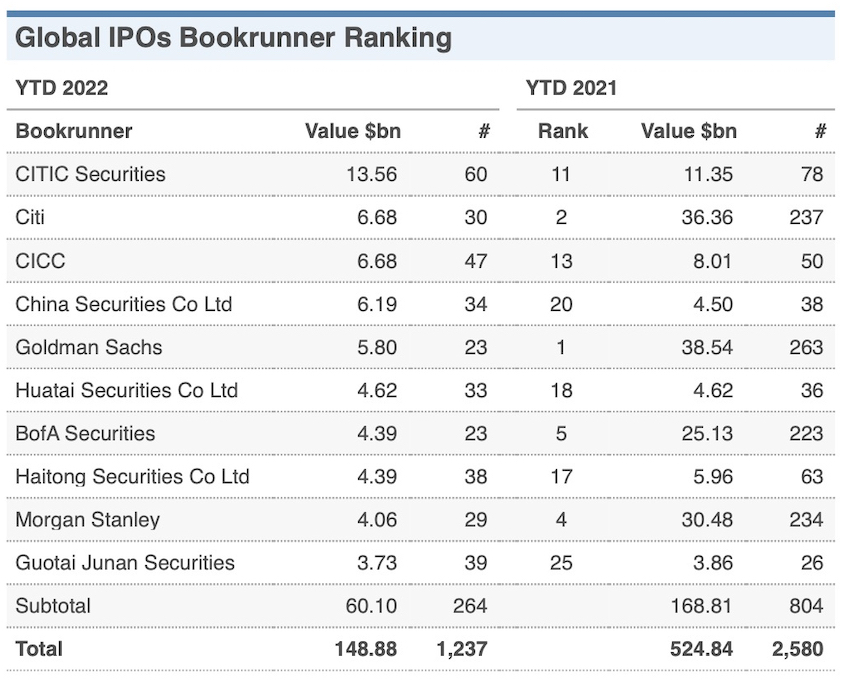

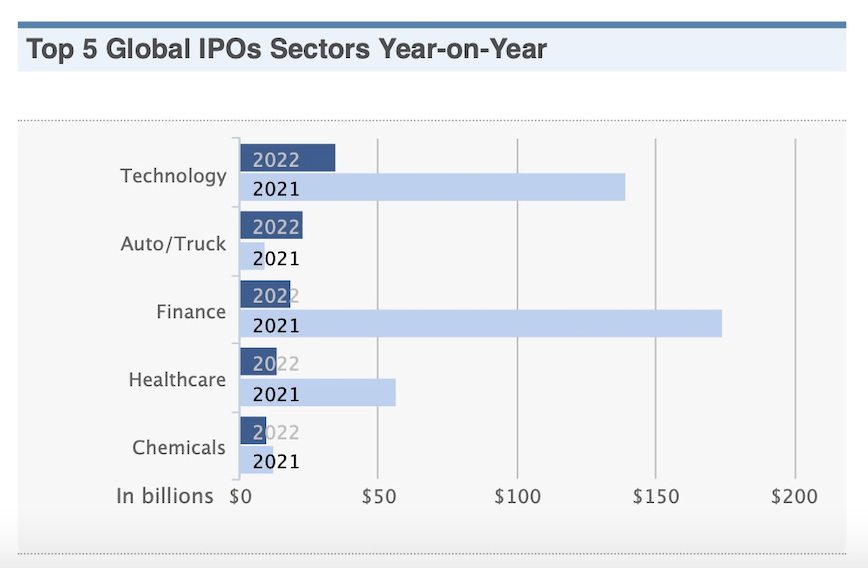

Global IPO volume declined swiftly 70% YTD in 2022 with the market momentum of a total of 992 IPO deals decline from 1,773 IPOs YTD in 2021 (Figure 1). Technology sector leading the IPO volume in 3Q22 continued to lead in size, and numbers, however, did decline from 3Q21 from 631 IPOs ($126.43B in volume) in 2021 to only 218 IPOs ($31.7B in volume) in 2022 Year-over-Year. Following, was attributed to the automotive sector leading on proceeds with 176% reflecting a swift incline from just $6.15B in 2021 to $23.14B in 2022 Year-over-Year (Figure 2).

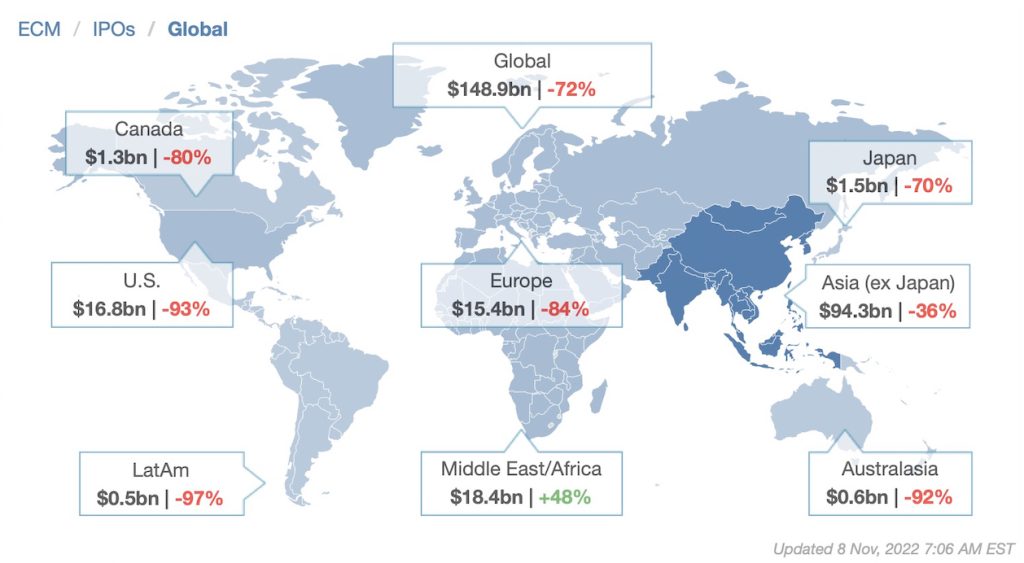

Major economies and financial markets in the Americas and EMEIA remain under pressure as quantitative tightening kicks into a higher gear. America’s exchanges experienced the harshest decline, recording only 116 deals raising US $7.5B YTD, a decrease of 94% in proceeds and 72% in volume Year-over-Year thus contradicting a record-breaking year in 2021. America’s IPO activity submerged to its lowest level in nearly 20 years.

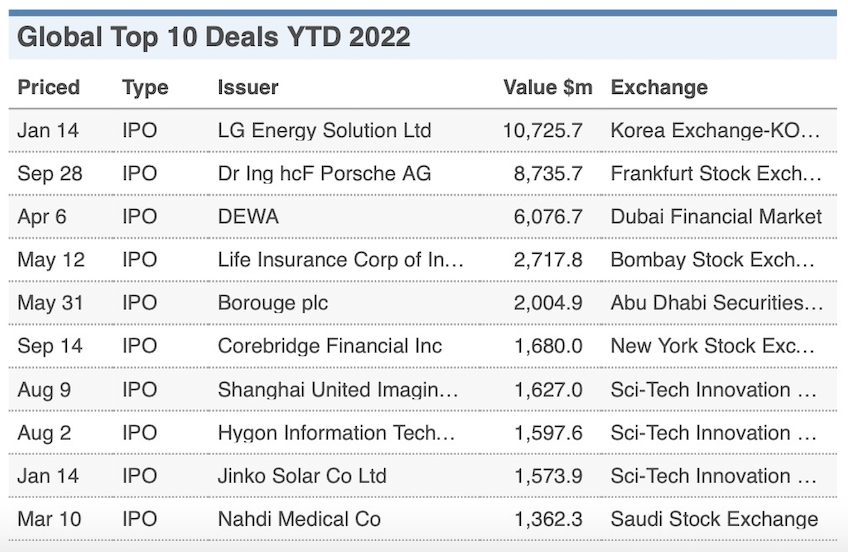

EMEIA IPO activity fell by 49.9% and 48% by number and proceeds, respectively. Europe sank over 70% in proceeds, but the Middle East continued to pivot favorably in large part attributed to its energy sector reflecting a $6.09B increase in proceeds in Q3 vs. $1.36B prior year (Figure 3). As the region has been somewhat impacted by inflation and geopolitical issues, Asia-Pacific exchanges have performed favorably, safe harboring five of the top 10 global IPOs YTD and has contributed 61% and 68.4% of the global share of IPOs and proceeds, respectively. Nonetheless, recording declines of 608 IPOs in 2022 vs. 816 IPOs in 2021 with 22% decline in proceeds YTD.

Significant IPO proceeds generated by the Auto/Truck sector in 2022 YTD, were attributed to two key deals (Figure 4):

– South Korea – Battery for EVs Manufacturer LG Energy ($10.7B)

– German Porsche luxury automobile manufacturer ($7.9B)

II. U.S. IPO Market Outlook

The U.S. saw the lowest Q3 IPO proceeds in over five years in 2022, 37 IPOs raised $3.2B. New Traditional IPO deals have sharply declined from 82 IPO deals in 3Q21 to only 5 IPO deals in 3Q22.

Special Purpose Acquisition Companies (SPACs) were a large component of the IPO surge in 2021 with a total of 88 IPO deals in 2021, to reflect a bear market with continued downward trend of only 6 SPAC IPOs in 3Q 2022. This is largely attributed to lack of Private Investment in Public Equity financing. As such, many of these transactions will seek retirement to ensure a return to their shareholders.

The US IPO market is sharply muted when comparing 1Q21 activity of $121.7B in proceeds vs. $10.85B in proceeds as of 1Q22 followed by a grave decline in 3Q22 of just $2.6B.

Year to Date, more than 60% of IPOs have been withdrawn largely accredited to the current market and uncertainty that lies ahead.

From a sector standpoint, Finance continues to lead in IPO activity as well as volume with $11.81B in 2022 YTD followed by Healthcare sector leading with proceeds of $2.23B in 2022 YTD. Finance sector has sharply declined when compared to $124.8B proceeds from 2021 YTD.

In 3Q22, U.S. gained momentum solely from one deal in the Finance sector attributed to the AIG spin-off (Corebridge Financial Inc.) which accounted for 50% of U.S. IPO proceeds of $1.7B.

The U.S. has set the lowest activity since 2003, mainly due to inflationary concerns as the Federal Reserve seeks to engineer an economic slowdown to achieve the 2% rate over a period of time thus creating a concerning macroeconomic backdrop for investors and shareholders.

III. IPO Watch – 2023 and Beyond

The majority of IPOs have been backed by Private Equity (PE) firms who are reflecting a rather inactive pipeline YTD and are surely preparing an exit strategy for the majority of their seasoned companies via M&A or IPO, once the market returns.

Investors will continue to focus on high growth IPO candidates who maintain strong liquidity and cash flow as a strategic and competitive advantage. Inventors will likely keep a watchful eye on commodity price stability, positive earnings reports, and reductions in volatility for the IPO market to reopen.

Inflation is at an all-time high followed by rising interest rates thus adversely affecting the global equity market. Geopolitical tensions and the pandemic led to more market uncertainty and volatility by welcoming headwinds for risk assets as 2022 comes to a close.

It is highly predictable, in the Americas, IPO pipelines are waiting for the market to reopen in 2023 as we expect interest rates to decline. EMEIAs IPO window continues to toughen with respect market conditions causing the IPO outlook to likely remain at a stalemate. As for APAC, activity remains robust in the background as companies assess their options for 2023 although, wise to bear in mind numbers have declined YTD.

Overall, IPO candidates looking to go public will likely come to realize valuation will be significantly lower when compared to the heights to 2021 however, there is significant optimism in the IPO market and activity likely to commence its upward trend in 2023.

Investors will likely seek out options in promising sectors (Green energy; technology; Biopharma; Auto/Energy-Globally), aiming outside of SPAC transactions at least short-term and closely monitor commodity pricing.

Key Themes investors will likely seek out to ensure the IPO markets has re-opened include:

– Ensuring volatility is stabilized by monitoring VIX (at 20 level)

– Ensure stabilization of equity markets with index performance

– Resilience in post-IPO performance (keen focus on Cash/Liquidity)

– Closely aligned valuations between investors and issuers

– Ensuring evidence of stability through macroeconomic and geopolitical

uncertainties.

Dora Foto, Director of Internal Audit, plays an instrumental role in enhancing quality service to shareholders by reinforcing trust and assurance as she assists organizations in navigating through the lifecycle of pre-IPO readiness, all the way through the offering process and beyond by providing expertise in capital markets alternatives and IPO market trends.