Third Quarter 2022: Bear Market Rally Fizzles as Interest Rates Rise

U.S. stocks ended the quarter off 4.7%, down 24.8% in 2022 and at a two-year low

– Bonds also reached new lows, extending historic drawdown, down 15% in 2022

– High inflation (latest CPI from August of 8.3%) driving a more aggressive Fed policy – base rate now seen rising to 4.6% peak in 2023 from 3% now

– Increased risk of recession – recently surveyed at 52% probability for the U.S. but key question is how deep it might get

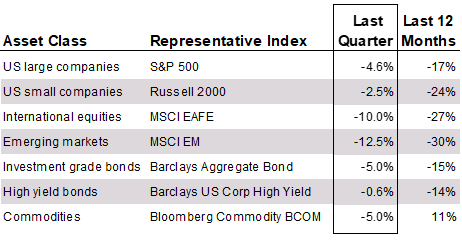

Market Performance: Third Straight Down Quarter

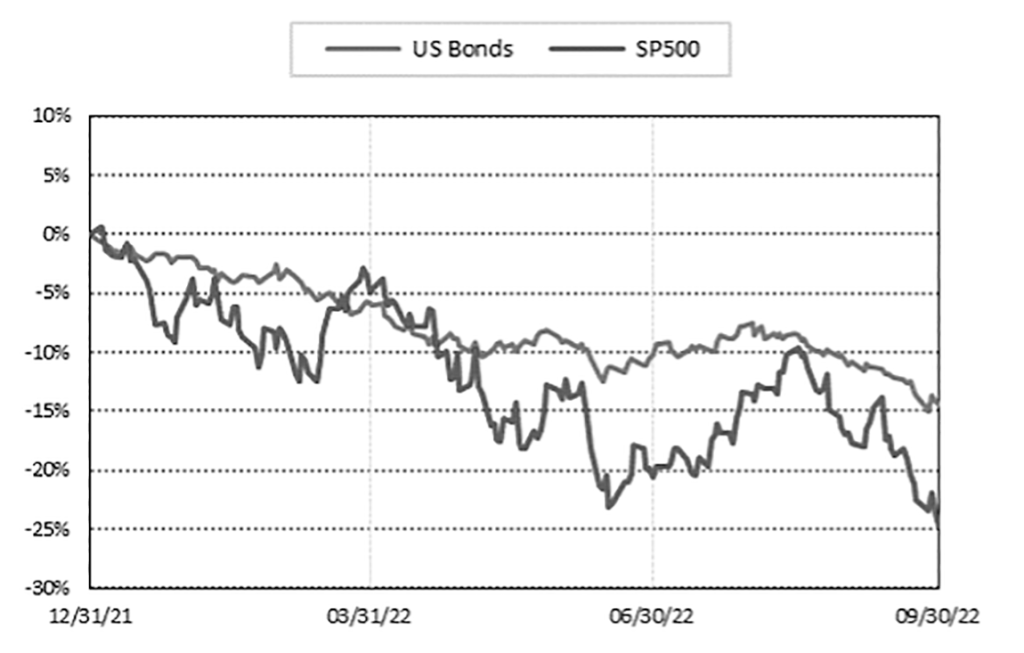

Global equity markets continued to decline in Q3, reconfirming a bear market for the SP500 and entering a tenth month of drawdown with very little optimism in the financial press. World equities have now declined 25% total return in 2022; U.S. stocks similarly have produced a -24.8% return in 2022. For Q3, U.S. stocks returned -4.7% after a -9.3% September meltdown that erased the summer’s relief rally. It was a particularly painful quarter as hopes for a market bottom in June and a Fed reversal on aggressive rate increases were dashed by high inflation data and hawkish Fed commentary. The June-August relief rally saw equities cut their losses for the year in half with a stunning 17% surge in the SP500 before giving back all those gains later in the quarter. Elsewhere in the world, the Euro zone suffered particularly hard, between war and an energy crisis, down 33% in 2022. Bonds also surrendered gains in September to close 5% lower in Q3, extending losses to a staggering 15% in 2022, the worst performance since at least 1926. Despite high inflation, even commodities had a loss for the quarter, gold down 4.1% in the quarter and down 9% overall in 2022.

Major Asset Category Index Price Returns for Q3 2022

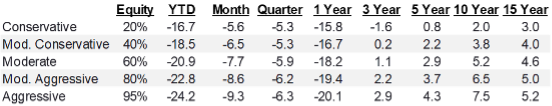

Losses for diversified portfolios continued to mount in Q3 ‘22 with especially disconcerting levels for conservative investors. Despite high inflation, cash has been a better investment than stocks or bonds in 2022, even though bank money market rates are lagging well behind Fed funds. At the current projected rate for Fed funds, it is possible cash will be yielding over 4% interest by the end of the year.

Returns on Diversified Portfolio Indices as of September 30, 2022

Outlook: Darkest Before the Dawn?

The last quarter was merciless to optimistic investors, extinguishing a rally and returning more losses. The Fed’s own interest rate forecast has risen to 4.6% peak from 3.8% peak forecast in June. High inflation and high probability of recession are coexisting now as semi-stagflation. U.S. real estate has shown signs of downturn as home sales volume decline and prices soften. It is almost a given the U.S. will experience a period of well below normal growth if not worse. The outlook for corporate earnings is hazy: although official SP500 estimates still show growth in 2022 and 2023, downward revisions have been more steep than usual. The strong dollar is driving inflation abroad and impacting U.S. multinationals’ profits. Finally, geopolitics/the Ukraine war remains a wildcard with heightened nuclear rhetoric.

Nonetheless, the most probable outcome still appears to be a moderate technical recession that doesn’t dramatically affect earnings and that inflation will begin to decline soon. The Fed’s rate increases may end as soon as Q1 2023 and its long-term direction from there will be downwards if inflation declines adequately. Anecdotally, inflation does finally seem to be moving lower as illustrated in today’s manufacturing PMI contraction. If inflation does begin to decline, the Fed will almost certainly respond to recessionary conditions with some modification of monetary tightening that would be a positive for financial markets. So, from a certain perspective, the current bleak outlook contains the seeds of its eventual reversal.

Portfolio Implications: Tax Loss Harvest, Hold, Rebalance, Average Cost Buy

After a 25% drawdown in equities, market indices are probably within 10-15% of a worst-case bottom that might be expected in a cathartic selloff from a severe recession like 2008 or 2020. Lemons to lemonade, the drawdown does open up possibilities for tax loss harvesting in taxable accounts. In addition to the commonsense adage to not panic at these levels, portfolio rebalancing and average cost buying have been historically positive when the stock market is down heavily.

Brian Schaffield is an investment advisor based in Santa Barbara and has been in the financial industry for 31 years. Nothing in this article serves as the receipt of, or as a substitute for, personalized investment advice.